Equally a few positive months might signal that you’ve got money to expand or invest. paying salaries, loan payments, and rent. Too many negative weeks might spell trouble, and you’ll need to do some forward-planning to make sure you can meet your commitments - e.g. You can then keep a running total, from week to week, or month to month, to get a picture of your cash flow forecast over time. That will give you either a positive cash flow figure (you’ve got more cash coming in than you’re spending) or a negative cash flow figure (you’re spending more than you’ve got coming in). Work out your running cash flowįor each week or month column, take away your net outgoings from your net income. Once you’ve listed everything you spend, add up the total for each column to get your net outgoings. For each week or month, make a list of all the money you’ll be spending, for example: Now you know what’s coming in, work out what you’ve got going out. Put the figures in for when you know clients will pay invoices, or bank payments will clear.Īlso remember to include all non-sales income, for example:Īdd up the total for each column to get your net income. Remember though, this is about when the cash is actually in your bank account. You might be able to predict this from previous years’ figures, if you have them. Start with your sales, adding them to the appropriate week or month. Have one column for each week or month, and one row for each type of income. It’s part of a smarter, more sophisticated treasury relationship that redefines insights and delivers efficiency. List all your incomeįor each week or month in your cash flow forecast, list all the cash you’ve got coming in. CashPro Forecasting from Bank of America is the smart solutionpowered by machine learning and predictive analyticsthat’s easy to use and provides complete visibility into all your accounts, including those at other banks.

Easy cashflow forecast curve update#

As things change, or you get more exact estimates, you can update your plan. Your cash flow forecast can change over time. If you’re a new business, you might not have a huge amount of data - so the further out you go, the less accurate your predictions will be.ĭon’t worry too much if you can’t plan far ahead. If you’re well-established, you might have a predictable sales pipeline and data from previous years. Plan as far ahead as you can accurately predict. Decide how far out you want to plan forĬash flow planning can cover anything from a few weeks to many months.

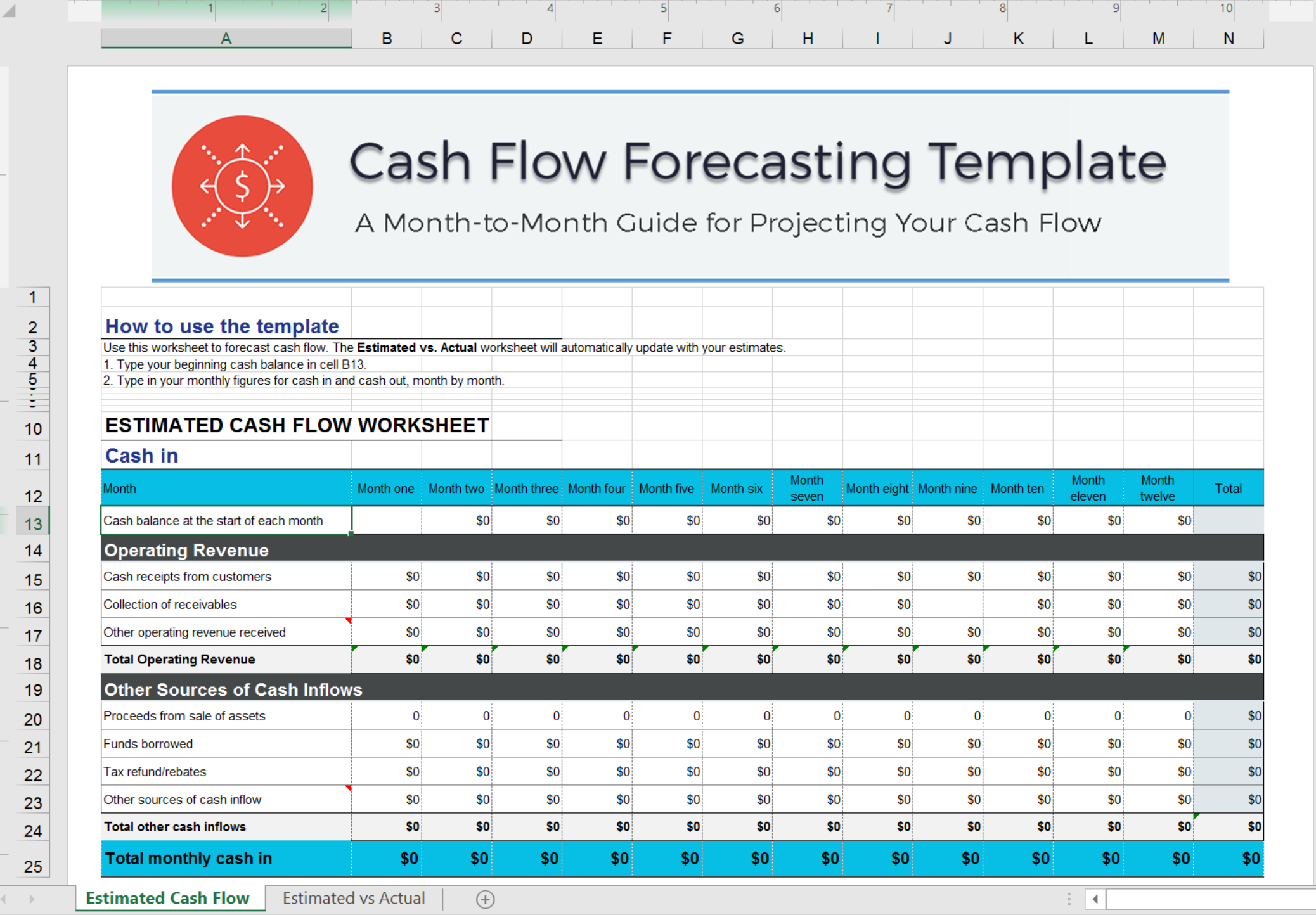

Or you can follow the four steps below to build your own cash flow forecast.

Easy cashflow forecast curve software#

One option is to use free financial forecasting software online, which can help you plan ahead for the next week, 30 days, or six weeks. Four steps to a simple cash flow forecast

0 kommentar(er)

0 kommentar(er)